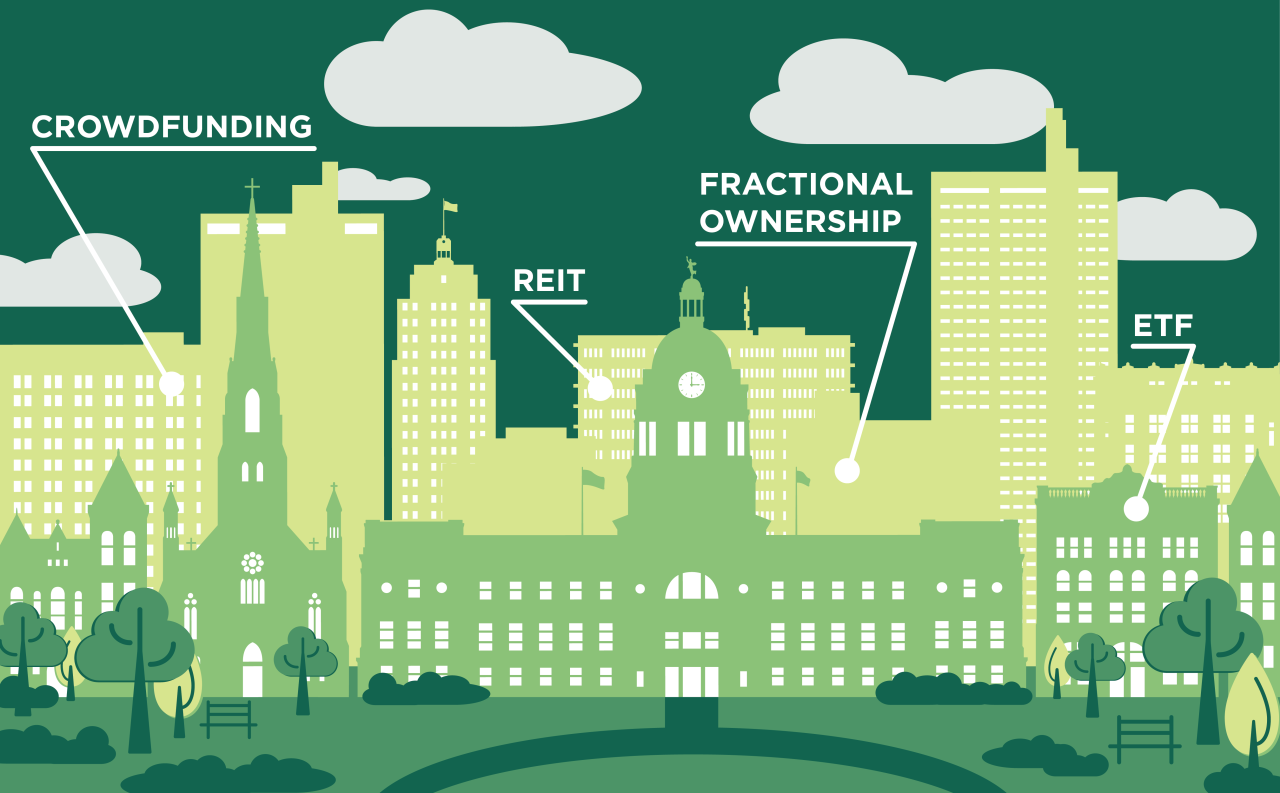

4 Proven Ways to Invest in Commercial Real Estate

Investing in commercial real estate is a financial endeavor that one should not take lightly.

As a long-term venture, commercial real estate investments can have high risk, but equally high reward, so it is vital to understand what your options are when it comes to the beginning of your investment journey. Finding the method and the path that works best for you will help maximize your returns and improve the long-term investment benefits.

Here’s a quick guide to the most common ways to invest, along with their benefits and drawbacks.

1. Real Estate Investment Trusts

According to Investopedia, a real estate investment trust, or REIT, is a company that owns, operates, or finances income-generating real estate.

![]()

Similar to the function of mutual funds, in a REIT, your investment adds to a pool of funds that goes towards multiple assets. In the trust, the assets are chosen by a fund manager based on the dynamics of the market. Then, returns from the assets go towards the investors based on how much they invest.

The main issue with REITs, though, is that a portion of your investment has the chance of being idle if the asset chosen is not attracting tenants who in turn generate returns. If you have a good fund manager, however, the likelihood of your investment staying idle in an unattractive asset with next to no tenant will therefore be lower.

If you want to contribute to your portfolio while still avoiding a traditional real estate transaction, an REIT is the choice for you.

2. Fractional Ownerships

![]() Unlike REITs, fractional ownership investments give you more control over what asset your investment is going towards. Instead of only being able to completely withdraw from the fund in order to avoid losses as in a REIT, you can trade ownership of non-performing assets with other better-performing assets.

Unlike REITs, fractional ownership investments give you more control over what asset your investment is going towards. Instead of only being able to completely withdraw from the fund in order to avoid losses as in a REIT, you can trade ownership of non-performing assets with other better-performing assets.

Instead of having a funds manager, fractional ownerships are more direct and are shares that are sold to individual shareholders, who gain benefits like usage rights, income sharing, priority access, and reduced rates.

If you’d like more control over where exactly your investment is going and flexibility in pulling out, trading, or selling, fractional ownership is the choice for you.

3. Real Estate Crowdfunding

Real estate crowdfunding involves a group of investors contributing funds to finance a real estate project. Platforms facilitate this process, allowing individuals to invest in specific properties.

![]()

What’s beneficial about crowdfunding is its reduced barriers to entry. An investor can participate in projects without the need for extensive real estate knowledge or large amounts of capital. Crowdfunding also allows professional management of your project, covering fees, due diligence, and ongoing management. But that does mean potential added fees on top of your investment in exchange for these benefits.

So, if you’d like a more hands-off approach and have a strong network in place, real estate crowdfunding may be the best option for you.

4. Exchange-Traded Funds

Real estate exchange-traded funds (ETFs) are investment funds that are traded on stock exchanges and aim to replicate the performance of a real estate index. They invest in a diversified portfolio of real estate assets.

![]() Investors can gain exposure to the overall real estate market without having to select individual properties. ETFs provide liquidity as stocks, which makes them suitable for investors who aren’t looking for direct real estate ownership. However, this means market dependency. Owning stock in a small part of many real estate markets means that if the market sees a downturn, your investment will reflect that.

Investors can gain exposure to the overall real estate market without having to select individual properties. ETFs provide liquidity as stocks, which makes them suitable for investors who aren’t looking for direct real estate ownership. However, this means market dependency. Owning stock in a small part of many real estate markets means that if the market sees a downturn, your investment will reflect that.

If you’re more comfortable with risk and aren’t looking for direct ownership, exchange-traded funds may be best.