Improving Equity Through Out-Of-State Property Investments

Let’s say you live in a location that has a higher cost of living than the U.S. average. It’s going to be difficult for you to enter the investment market with higher expense rates, taxes, and barriers.

Or, perhaps you live in a location with falling real estate prices; it would be wiser to look elsewhere in the country for investment opportunities.

That’s why out-of-state property investments are so important!

Keeping your investment pool in one location isn’t your only option for improving equity, and this blog will cover exactly why.

But first... what is equity?

Equity: A Quick Rundown

According to Investopedia, equity is the “amount of money that would be returned to a company’s shareholders if all of the assets were liquidated and all of the company’s debt was paid off in the case of liquidation”.

In simpler terms, equity is the value of your stakes in the investment, the money value in excess of claims or liens against it. When you’re investing in an out-of-state property, your equity is improved because of the difference in market values and higher returns on investment. If you invest in a location that has better markets compared to your own, your investments will balance out.

Benefits of Investing Out-of-State

Having your investment balanced in your portfolio is just one of the benefits of investing in out-of-state properties, but how exactly can equity be improved? Here are a few ways:

1. Out-of-state investments promote diverse portfolios.

![]() Curating an investment portfolio that is diverse will ensure that risk levels of different types of assets will average out. Generally, you can benefit from spreading all your investments amongst lots of different assets, and a few different locations.

Curating an investment portfolio that is diverse will ensure that risk levels of different types of assets will average out. Generally, you can benefit from spreading all your investments amongst lots of different assets, and a few different locations.

If one location you’re invested in performs poorly, another location performing better will keep you afloat. Having geographical diversity is just as important as having asset class and type diversity, so looking for out-of-state investment properties is the way to go.

2. Out-of-state investments are more financially feasible.

![]() If you live in an area that’s more expensive, chances are another state has lower prices and higher returns on investment. Looking into taxes, rates, expenses, and prices will help you figure out the best location to invest in so you can receive the highest return on your investment.

If you live in an area that’s more expensive, chances are another state has lower prices and higher returns on investment. Looking into taxes, rates, expenses, and prices will help you figure out the best location to invest in so you can receive the highest return on your investment.

For example, if you live in San Francisco, a very expensive place, investing within your hometown might be out of the question. Researching and investing in a cheaper location, like Indiana, may be a better option for you. While far away from San Francisco, Indiana’s cost of living is low compared to the rest of the country and has many opportunities for investment.

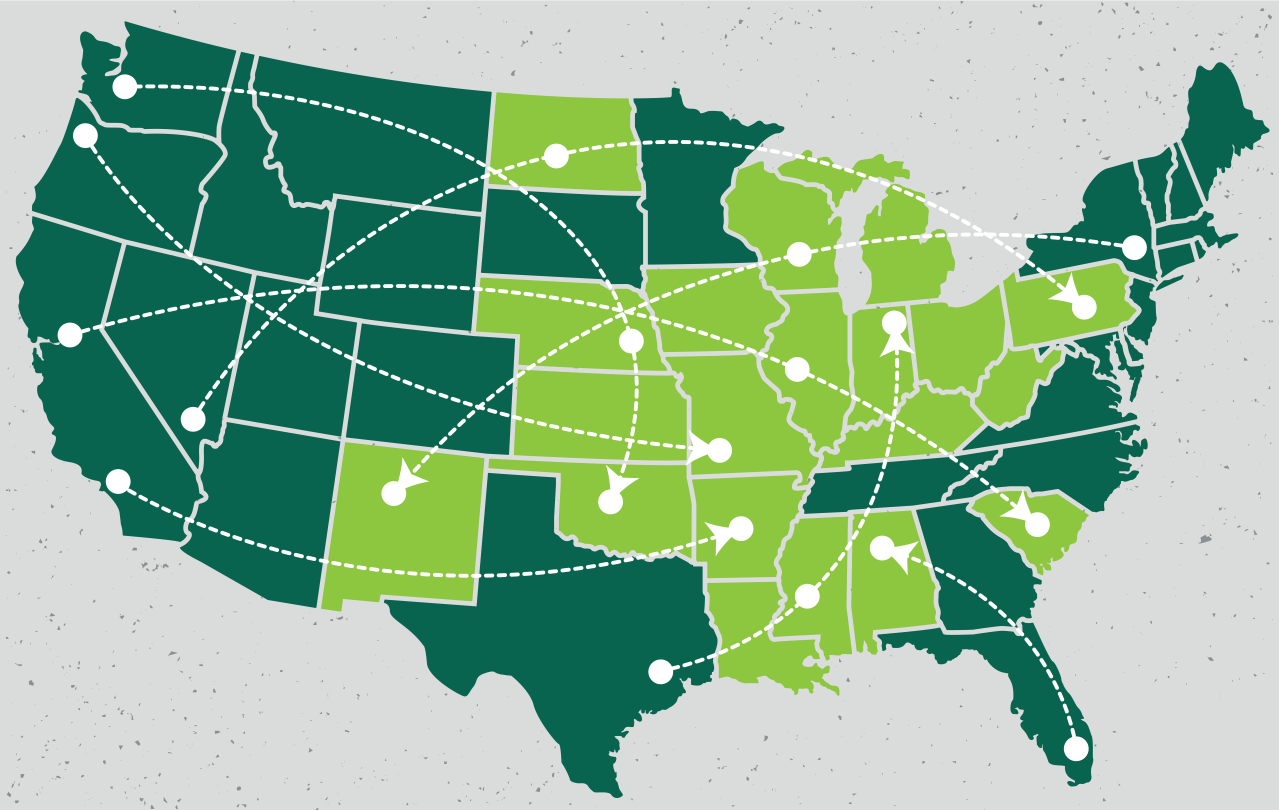

3. Out-of-state investments bring more market opportunities.

![]() When looking for out-of-state investments, you’ve unlocked a whole country’s worth of opportunities. This is especially helpful if you live in a smaller state or a less-populated state, like Rhode Island or Wyoming.

When looking for out-of-state investments, you’ve unlocked a whole country’s worth of opportunities. This is especially helpful if you live in a smaller state or a less-populated state, like Rhode Island or Wyoming.

What’s most important in this regard is networking, as you’ll really need to make connections to find a good property manager, broker, maintenance technician and more, so that owning the property away from home won’t be too stressful.

Out-of-state investment opportunities shouldn’t be disregarded. When done right, you have the chance of equalizing your investment risk factors, networking around the country, and gaining more returns and better opportunities.

Case Studies

Below are a few of our case studies showing how Sturges Property Group helped out-of-state investors make big moves to the Fort Wayne and NE Indiana area.

The Power of Teamwork: Sturges Property Group Drives Sale and Renovation of Property to Houston-Based Investor